Which of the Following Services Is an Attestation Engagement

2 Providing financial analysis planning and capital acquisition services as a part-time in-house controller. A consulting service engagement to provide computer-processing advice to a client.

Attestation Services Engagements Examples Audits Standards

Traditional financial statement audit engagements render an opinion on the basic financial statements and corresponding footnote disclosures as a whole.

. Which of the following professional services is an attestation engagement. Tax engagements in which a practitioner is engaged to prepare tax returnsorprovidetaxadvice 05 an attest engagement may be part of a larger engagementfor ex- amplea feasibility study or business acquisition study may also include an examinationofprospectivefinancialinformationinsuchcircumstancesthese. Compilation review and audit.

Which of the following professional services is considered an attestation engagement. Accounting questions and answers. Likely to be structured as an attest engagement.

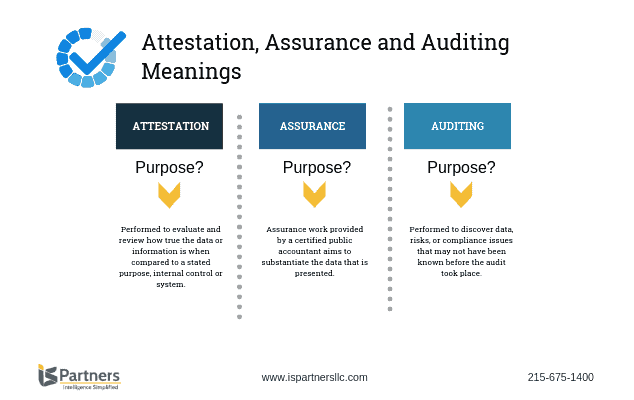

Attest engagements include those in which a practitioner is engaged to issue or does issue an examination a review or an agreed-upon procedures report on subject matter or on an assertion about the subject matter that is the responsibility of another party as well as engagements related to prospective financial statements. Attestation Engagements The audit of financial statements is the most common attestation service but there are several others like agree-upon procedures engagements review and examination engagements. An attestation engagement is an arrangement with a client where an independent third party investigates and reports on subject matter created by a client.

An income tax engagement to prepare federal and state tax returns. What professional services is an attestation engagement. Questions Answers Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation.

Which of the following professional services is an attestation engagement. Read the full answer. 1 Advocating on behalf of a client about trust tax matters under review by the Internal Revenue Service.

A consulting service engagement to provide computer-processing advice to a client. QUESTION 17 Which of the following professional services would be considered an attestation engagement. An attestation engagement is an arrangement with a client where an independent third party investigates and reports on subject matter created by a client.

An engagement to report on compliance with statutory requirements. Agreed-upon procedures historical or future performance or financial data compliance physical characteristics such as the size of a facility that is important in the sale of business an analysis of sorts functioning of internal controls governance. Examples of attestation engagements are.

Answer of. A consulting service engagement to provide computer-processing advice to a client. 2 An engagement to report on compliance with statutory requirements.

An income tax engagement to prepare a tax return. Which of the following professional services is an attestation engagement. Pro forma financial statements.

With requirements of specified laws through a variety of services including agreed-upon procedures engagements and various. And Managements Discussion and Analysis. There are three types of attestation services.

Correct because CPAs may provide assurance as to compliance. Which of the following professional services is an attestation engagement. Attestation engagements include the following services or forms.

Agreed-upon procedures excluding letters to underwriters and consulting services or any attest engagement concerning assertions about solvency. 1 A consulting service engagement to provide computer processing advice to a client. Some of the examples of attestation engagements include the following.

Attestation examination engagements render an opinion on specific financial and nonfinancial data or processes. Which of the following professional services is an attestation engagement. Reporting on pro forma financial information formulated by a client.

A consulting service engagement to provide computer-processing advice to a client. Internal control over financial reporting. Examples of attestation engagements are.

An engagement to report on compliance with statutory requirements. Dont use plagiarized sources. Reporting on pro forma financial information formulated by a client.

Which of the following professional services would be considered an attestation engagement. 1 A consulting service engagement to provide computer-processing advice to a client 2 An engagement to report on compliance with statutory requirements 3 An income tax engagement to prepare federal and state tax returns. 1 A management consulting engagement to provide IT.

Compliance reporting regulatory or contractual. In these services auditors perform audit procedures to. Reporting on how well the internal controls in a client process function.

A An examination of internal controls. B A review of prospective financial information. Footnotes AT Section 101Attest Engagements.

Nonattest services are services provided to a client that are not specifically related to the performance of an attest engagement. Which of the following professional services is an attestation engagement. Agreed-upon procedures are one of the common examples of attestation engagement.

Fn 1 For a definition of the term practice of public accounting see Definitions ET section 9225. Financial forecasts and projections. Fn 2 See section 301 Financial Forecasts and Projections paragraph 02 for additional guidance on applicability when engaged to provide an attest service on a financial forecast or projection.

An engagement to report on statutory requirements. Attestation review engagements offer limited assurance on such data or processes. Reporting on financial projections made by a client.

An income tax engagement to prepare federal and state tax returns. Which of the following services is an attest engagement. Get Your Custom Essay on.

Like other engagements attestation engagements seek to provide assurance. These may include many different types as mentioned above. 1 A consulting service engagement to provide computer-processing advice to a client 2 An engagement to report on compliance with statutory requirements 3 An income tax engagement to prepare federal and state tax returns 4 The preparation of financial.

If you perform nonattest services for an attest client the independence rule and related interpretations rules impose limits on the nature and scope of the services you may provide.

Comments

Post a Comment